Global Tobacco Industry Transformation

Global Tobacco Industry Transformation with 2CS

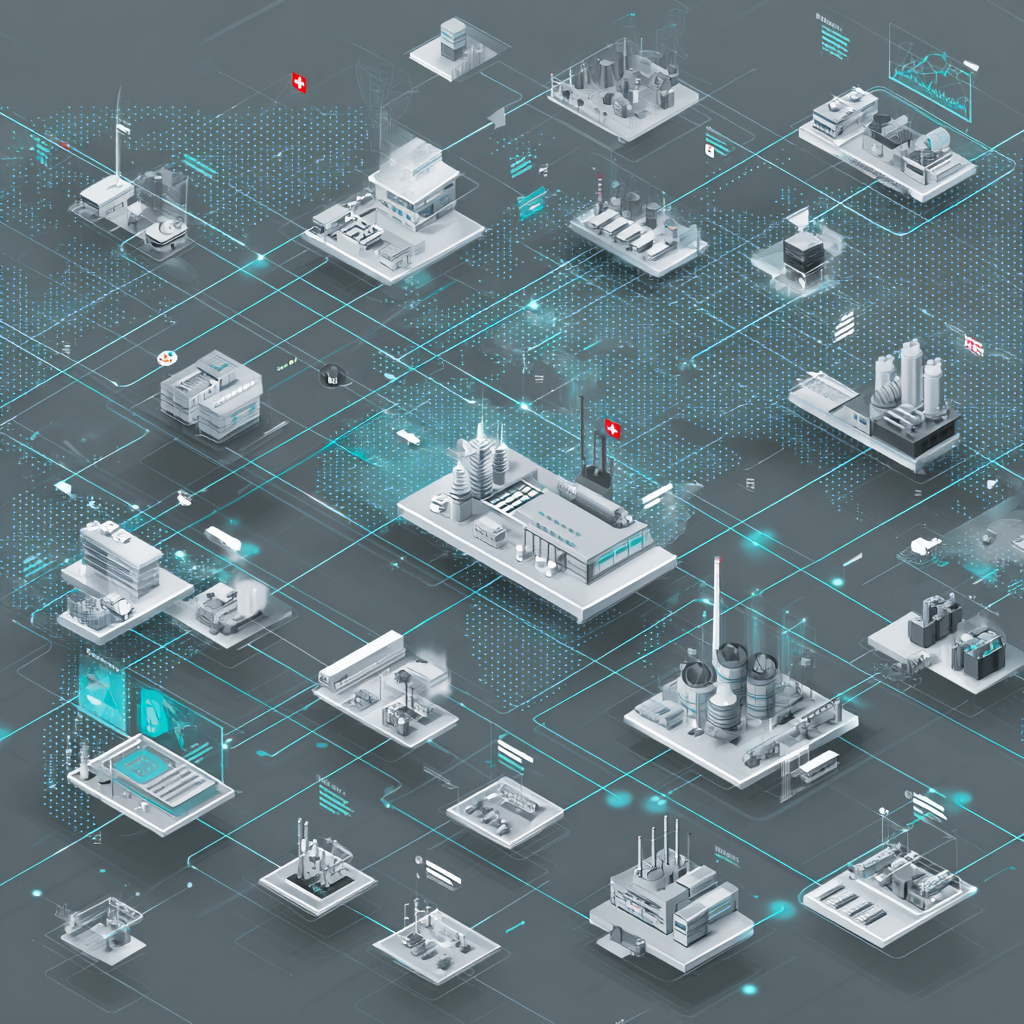

At Consulting Convergence & System SA (2CS), we drive a global transformation in the Tobacco Industry with innovative, scalable IT solutions tailored for manufacturers, distributors, regulatory bodies, and advocacy groups across Asia, Africa, Eastern Europe, and beyond. Based in Geneva, Switzerland, our expert team delivers world-class technology underpinned by Swiss precision, emphasizing traceability and tax management to combat illicit trade and ensure compliance.

In today’s highly regulated tobacco landscape, businesses face escalating challenges from counterfeit products, tax evasion, and complex regulatory reporting. 2CS addresses these with advanced traceability and tax management solutions, leveraging tools like Codentify for secure product tracking, Java and AWS for scalable data processing, ensuring full visibility from production to sale across diverse tobacco ecosystems.

Your Global Tobacco Industry Roadmap with 2CS

We partner with you to tackle traceability and tax demands with a proven, region-spanning approach:

Strategic IT Consulting

We design strategies to implement end-to-end traceability for Asian tobacco firms in India, and enhance tax reporting in Kenya, aligning with local regulations like China’s Tobacco Monopoly Law or Nigeria’s excise policies.

Custom Software Engineering

Our developers build traceability platforms using Java, supporting Eastern European manufacturers in Poland and mobile tax verification apps for African distributors.

Cloud Migration Expertise

We migrate legacy systems to AWS, enabling real-time traceability for Southeast Asian supply chains and Russian exports, with ISO 27001 compliance.

MRO Innovation

We modernize outdated tracking systems in the Middle East with reverse engineering, upgrading for digital tax stamps while preserving historical data.

Cyber Security Solutions

We secure traceability data with encryption and IDS (using Splunk, citation: Splunk Inc., 2025), protecting Asian giants and African networks from fraud.

Computer Vision Technology

Our PyTorch-driven vision systems scan tax stamps in Indian factories and verify authenticity in Eastern Europe.

System Architecture with CI/CD

We deploy scalable architectures with Jenkins CI pipelines, enabling rapid updates to traceability systems in Ukraine.

AI/ML Innovations

Using TensorFlow we predict tax evasion patterns for South African distributors and analyze supply chain gaps in Asian markets.

Software QA Testing

We ensure reliability with Selenium testing for tax apps in Southeast Asia, and audit Eastern European systems for compliance with JMeter.

Database Management

With Oracle Database, we normalize traceability and tax data in Asia, optimizing query speed, and enhance African record reliability.

Log & Monitoring

Using ELK Stack we monitor transaction logs in Eastern Europe, providing alerts for discrepancies, and ensure uptime for Asian systems with Prometheus.

Ready to secure your tobacco operations worldwide with robust traceability and tax solutions?

Contact us at contact@2cs.ch (mailto:contact@2cs.ch) or +41 22 512 1 512 for a free global consultation and unlock your business’s potential!

Real-World Impact

A Southeast Asian manufacturer reduced counterfeit losses by 40% with our traceability approach.

An African distributor improved tax compliance by 30% using our cloud design solutions.

Philip Morris International enhanced global tax stamp tracking by 35% through our data migration assistance in their blockchain-based project.